As we edge ever closer to Christmas, it feels appropriate to take a look at sweet wines. Here we consider Alsace’s top 5 sweet whites by overall Wine Lister score. Produced in a thin sliver of land in the far East of France, Alsace’s top sweet whites are separated by just nine points (less than one hundredth of Wine Lister’s 1,000-point scale!). The five wines display very similar profiles, all outperforming in the Quality category, achieiving middling Brand scores, and trailing economically.

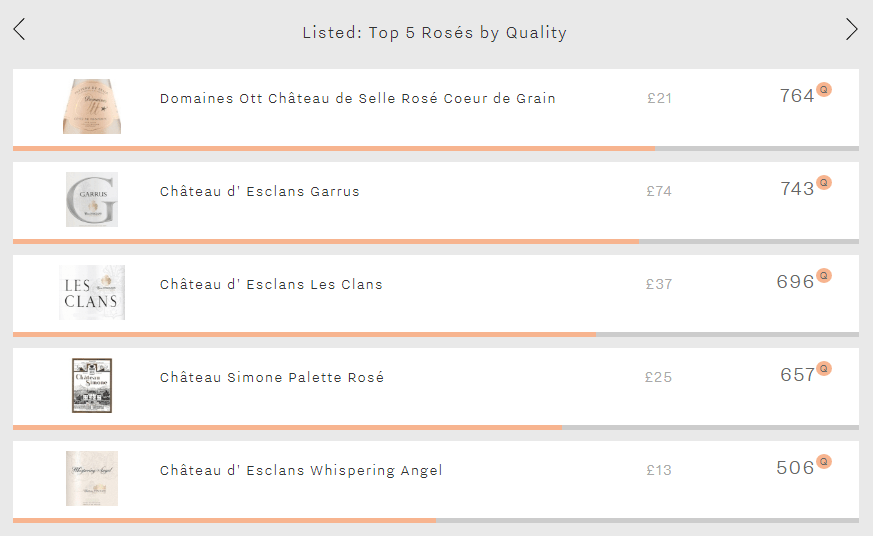

Four break the 900-point boundary in terms of Quality scores, putting them amongst the very top quality wines on Wine Lister. Hugel et Fils Riesling Vendange Tardive (VT) falls just short with 881 points, still a very strong Quality score (thanks to 17/20 from both Jancis Robinson and Bettane+Desseauve, and 92.5/100 from Vinous). The same producer’s Gewürtzraminer VT scores even higher for quality (910) thanks to a 95/100 from Jeannie Cho Lee:

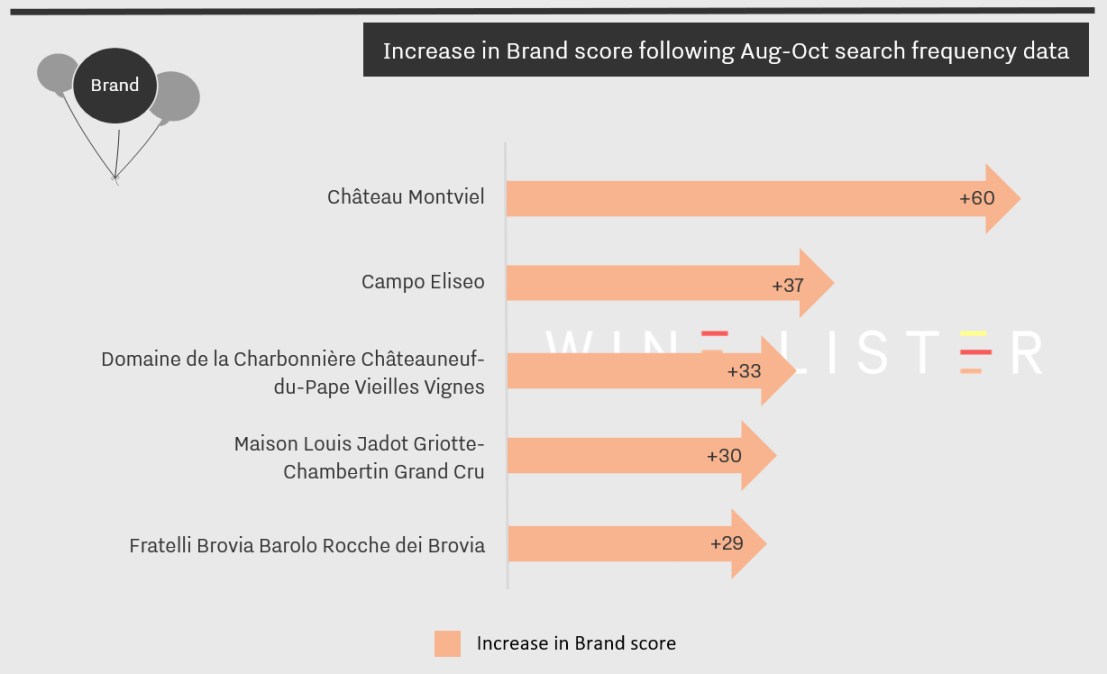

Moving categories, scores drop sharply from an average Quality score of 915 to 550 for Brand – still above the average for all wines on Wine Lister:

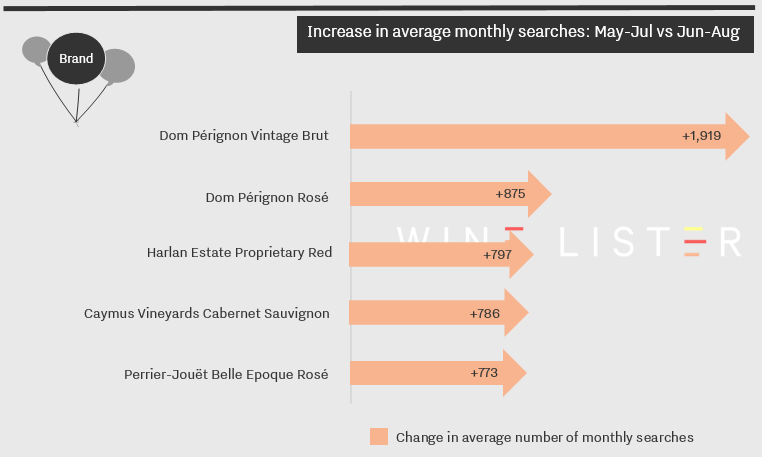

Economics scores trail even further behind, averaging 338, hindered by low liquidity. For example, Hugel’s Gewürtzraminer VT failed to trade a single bottle at auction over the past four quarters (as measured by Wine Market Journal). The chart below shows Economics score in the context of all the wines on Wine Lister – its is well below the average, with a score below 400 putting in the “weak” score band:

Other wines making the top five are Zind-Humbrecht Jebsal Pinot Gris VT (675) and Trimbach Gewürztraminer VT, which achieves the best restaurant presence of the group. However, featuring on just 6% of the world’s best restaurant lists, this suggests that Alsace’s sweet whites are not every sommelier’s must-list bracket, even when produced by the region’s most famous producer. Incidentally, Trimbach’s Clos Sainte Hune appears in 34% of wine lists (compared to 69% for Sauternes’ Château d’Yquem).

The last wine making it into this week’s Listed section is Marcel Deiss Altenberg de Bergheim Grand Cru. The only non-single varietal wine of the group, it is a blend of 13 different varietals planted in the same plot, and is by far Bettane+Desseauve’s preferred wine of the group – the French duo award it an average score of 19/20. It is also the most popular wine of the group. However, its modest average search frequency (380 per month on Wine-Searcher) confirms that Alsace’s sweet whites currently fly well under the radar.

So, when you’re stocking up your cellar for Christmas, give Alsace’s sweet whites a go. They might not be the most prestigious, but the quality is there and prices are pleasing.